Navigating the world of registered investment adviser (RIA) compliance is a complex but critical responsibility.

At the heart of successful financial planning lies a firm commitment to meeting regulatory responsibilities for financial planners.

Adhering to compliance not only protects your clients but also safeguards your firm’s reputation and operational integrity.

Understanding Your Compliance Responsibilities

The regulations for RIAs place a fiduciary duty on advisers, so they must put their clients’ best interests first in every situation.

RIAs must give clients full disclosures and safeguard client information.

Compliance requires vigilance, education, and adaptation beyond checklists and forms.

RIAs must adopt written policies and procedures that prevent violations.

The policies should address all aspects of the portfolio management process, trading, customers and client relations, and privacy.

Regular reviews ensure that these policies remain effective as regulations evolve.

Building a Customized Compliance Program

Each firm must have a compliance program tailored to the firm’s organization, products and services, and risk profile that identifies risks in the areas of client communications, recordkeeping, cybersecurity, and operational controls, and follows a risk assessment process.

Key features of a strong compliance culture are the firm’s visible commitment to compliance by executive management, a thorough compliance manual as a road map for employees, and a seasoned Chief Compliance Officer (CCO) who enforces compliance policies and provides continuing compliance training to employees.

Robust Recordkeeping and Documentation Practices

Recordkeeping is an essential part of an effective compliance program.

Firms/financial institutions must retain communications, transaction data, and agreements with clients for multiple years.

Such documentation is also used in regulatory examinations and audits.

Implement secure storage and retrieval systems that comply with regulations.

Automated approval and distribution processes for marketing materials and client disclosures may reduce the chance of errors and omissions.

Cybersecurity as a Cornerstone of Compliance

Secure protocols exist as the first priority.

Enforce strong cybersecurity protocols (especially respond to incidents), invest in client-side encryption, authenticate users with multiple factors, and oversee vendors and supply chains.

The integration of frequent vulnerability assessments with employee education improves security.

Firms can use a business continuity plan in case of unplanned disruptions to ensure the integrity of client data.

Preparing for Regulatory Examinations

Preparation via action reduces business risk and business disruption.

Regular internal compliance reviews can recognize areas for risk before they are found by regulators.

Training employees to comply with rules helps them apply policies with confidence.

When firms market materials, agree with clients, document remedial actions, and improve compliance programs, they build trust with both regulators and clients, making these actions key elements of compliance culture.

Ongoing Training and a Culture of Compliance

Compliance should be approached continuously.

Firms should regularly train employees in regulations, updates, cybersecurity practices, and ethics concerning compliance.

Continually educate in order to ensure the meeting of fiduciary duties and regulatory compliance.

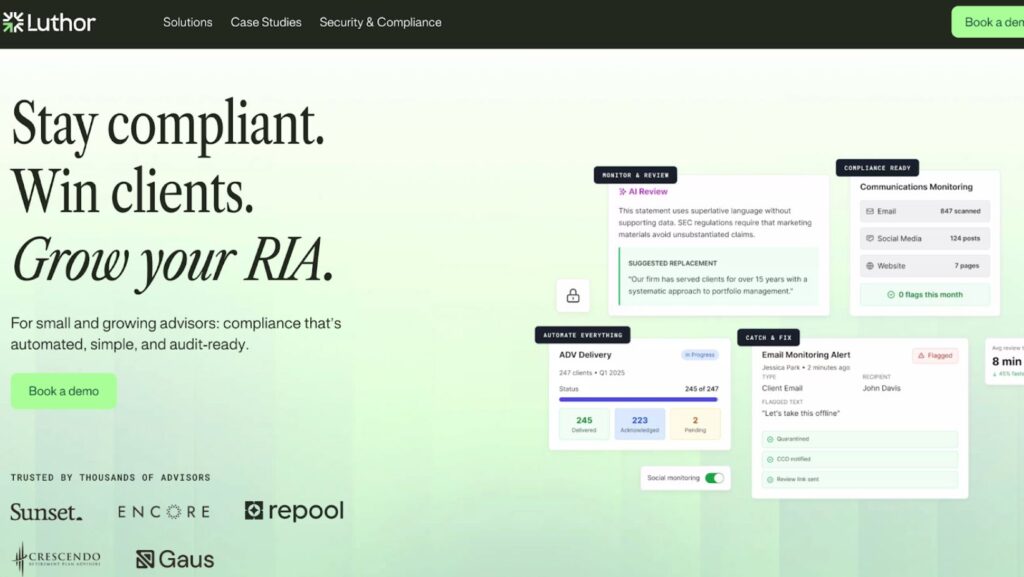

Automated compliance solutions, such as those that monitor tools and alert to real-time regulatory change, can free compliance officers from some lower-value tasks to focus on high-priority, calculated work.

Examples of process automation solutions include Luthor.ai‘s artificial intelligence (AI) tools for compliance document creation and monitoring, which can help organizations maintain compliance more efficiently.

Conducting Regular Compliance Reviews

Periodic evaluation.

Annual or more frequent assessments let an organization decide what policies and practices are working well, should be modified, and should be enforced.

Good compliance programs consider these reviews a normal part of operations, documenting findings and changing processes quickly based on findings and overall evaluation.

Conclusion

A financial planner may meet their obligations through a variety of proactive compliance measures, which depend upon the specific business model of the planner.

These compliance measures include customized compliance programs, disciplined recordkeeping, a solid cybersecurity program, active, thorough monitoring, and a culture of continuous learning and vigilance. If the right policies, training, and technology are in place, financial professionals can provide compliant, trustworthy, and high-quality services to their clients in a cost-effective manner.

More Stories

Purchasing a Used Spectrum Analyzer: A Smart Guide to Reliable and Cost-Effective Signal Testing

Coinisbet Builds Momentum as a Knowledge-Driven Korean Crypto Platform Blending News, Analysis, and Investor Community

What the World Can Teach Us About Feeding Children